How $200B Mortgage Bond Buying Impacts Greater San Antonio Markets

How $200 Billion in Mortgage Bond Buying Can Help the Real Estate Industry

When big institutions buy mortgage bonds, it can improve “liquidity” in the mortgage market — which can influence rates, keep loans flowing, and support a healthier pace of home sales in places like San Antonio, Cibolo, Schertz, and New Braunfels.

In early January 2026, reports described a proposed push for Fannie Mae and Freddie Mac to purchase $200B in mortgage-backed securities (MBS) to help improve housing affordability.

Think of it as “more buyers for mortgages,” which can help keep lenders confident and competitive.

First: what does it mean when mortgages are “bought”?

Most lenders don’t keep your mortgage for 30 years. After closing, they usually sell the loan into the secondary market. Those loans are often bundled into mortgage-backed securities (MBS) and purchased by investors and institutions.

So why does $200B matter?

A large wave of buying can increase demand for MBS, which can put downward pressure on MBS yields. Since mortgage rates tend to track the MBS market, that can translate into more stable or improved mortgage pricing for buyers.

Example of how sensitive rates can be: after news of the $200B proposal, industry reporting noted rates briefly dipping below 6% using a daily rate index. :contentReference[oaicite:1]{index=1}

How this helps buyers

- Potentially steadier rates: More MBS demand can help prevent sudden spikes in mortgage pricing.

- More loan availability: Lenders can originate more loans when they can sell them easily into a strong secondary market.

- More confidence to act: Buyers often re-enter the market when rate volatility cools down.

Why this is extra important for VA buyers

The VA program thrives when lenders feel competitive and liquid. When mortgage markets are healthier, VA buyers often see better lender participation and stronger day-to-day pricing consistency.

How this helps sellers

- More qualified buyers: If payments improve even modestly, more buyers can qualify.

- More showings and offers: Better affordability can increase foot traffic and reduce “wait and see.”

- Better market stability: Liquidity helps keep transactions moving — and protects values from sharp demand drops.

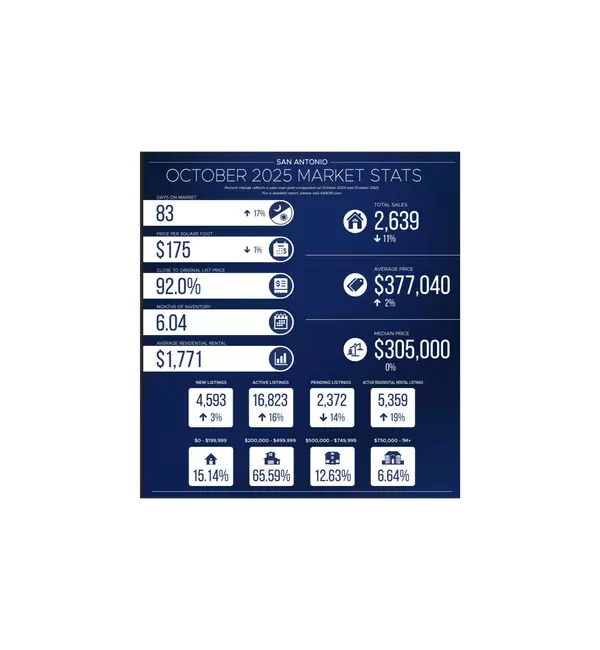

Local snapshot: San Antonio market context (latest available)

According to SABOR’s November 2025 market release, the San Antonio area saw: 2,206 homes sold, a median price of $315,000 (up 5% YoY), 5.9 months of inventory, and 86 average days on market. :contentReference[oaicite:2]{index=2}

In other words: we’re in a more balanced environment locally. Liquidity improvements (like major MBS buying) can help keep financing available and support transaction volume — even when buyers are cautious.

The bottom line

Large-scale mortgage bond buying is “behind-the-scenes,” but it matters because it can: keep lenders confident, improve rate stability, and help the market function normally. Reports around the January 2026 $200B proposal framed it as an affordability strategy tied to agency MBS purchases.

Disclaimer: This article is for educational purposes and is not financial advice. Mortgage rates vary by lender, credit profile, and market conditions.

Categories

Recent Posts

"Words cannot express our gratitude and thankfulness that Keith provided us when buying our home. Being a military family and not being able to physically be there is beyond challenging buying a house unseen. He made this whole process so pleasant and easy, always easing our minds because he had our complete best interests in his hands. He took the time to send videos, pictures, and did several walk-through of the home to make us feel like we were there. You can easily tell Keith has years of experience , always answering questions and helping us every step of the way! He was extremely helpful in guiding us through the process of buying our home, and making sure that everything was taken care of promptly and correctly. He has been nothing but extremely responsive and excellent since the first phone call! Keith is incredibly knowledgeable, a go-getter, and super professional. We truly sat in passenger seat and let Keith do the driving. He went above and beyond to find the perfect home for us. There's not another realtor out there that could've provided us with the ease and comfort knowing we were making all the right decisions! Keith and Sheila have our highest recommendation, and we wouldn’t ever want to work with any other agent. We will refer our friends and family to Keith and Sheila Realty again and again!" Nicole Olson - 2024