Secrets On Home Loan Mortgage Rates & A Strategy To Save Money On Your Mortgage

When it comes to buying a home, one of the most important factors to consider is the mortgage rate. This rate determines the amount of interest you'll pay on your loan, and ultimately affects your monthly mortgage payment. Today, we'll uncover some secrets about home loan mortgage rates that every buyer should know.

Firstly, it's important to note that mortgage rates are still historically low. In fact, they have been hovering near record lows for quite some time now. This means that there has never been a better time to take advantage of these rates and secure a favorable mortgage for your dream home.

One secret about mortgage rates is that they can vary depending on several factors. Lenders consider your credit score, income, and the loan-to-value ratio when determining the interest rate. It's crucial to have a good credit score and a stable income to ensure you qualify for the best rates available.

Another key point to consider is the length of your mortgage. The most common mortgage term is 30 years, but there are also options for 15 and 20-year terms. Shorter terms typically have lower interest rates, but it's important to choose a term that aligns with your financial goals and budget.

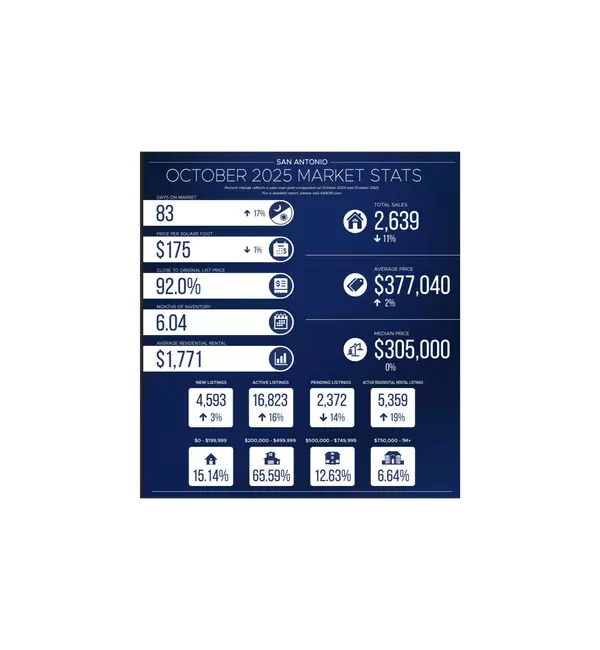

Staying updated on real estate news is also essential for buyers. The real estate market is constantly evolving, and changes in market conditions can impact mortgage rates. By staying informed, you can make informed decisions about when to lock in your rate and secure the best deal.

It's worth mentioning that mortgage rates fluctuate daily. To secure the best rate, it's crucial to work with a reputable lender and stay in touch with them throughout the process. They can provide valuable insights and guidance on when to lock in your rate to avoid any potential rate hikes.

In conclusion, home loan mortgage rates are still historically low, making it an opportune time for buyers to enter the real estate market. Remember that rates can vary based on your credit score, income, and loan-to-value ratio. Stay informed about real estate news and work closely with your lender to secure the best possible rate. With careful research and planning, you can find a mortgage that suits your needs and helps you achieve your homeownership dreams.

Categories

Recent Posts

"Words cannot express our gratitude and thankfulness that Keith provided us when buying our home. Being a military family and not being able to physically be there is beyond challenging buying a house unseen. He made this whole process so pleasant and easy, always easing our minds because he had our complete best interests in his hands. He took the time to send videos, pictures, and did several walk-through of the home to make us feel like we were there. You can easily tell Keith has years of experience , always answering questions and helping us every step of the way! He was extremely helpful in guiding us through the process of buying our home, and making sure that everything was taken care of promptly and correctly. He has been nothing but extremely responsive and excellent since the first phone call! Keith is incredibly knowledgeable, a go-getter, and super professional. We truly sat in passenger seat and let Keith do the driving. He went above and beyond to find the perfect home for us. There's not another realtor out there that could've provided us with the ease and comfort knowing we were making all the right decisions! Keith and Sheila have our highest recommendation, and we wouldn’t ever want to work with any other agent. We will refer our friends and family to Keith and Sheila Realty again and again!" Nicole Olson - 2024